20 October 2025

In the context of growing variability in climate policies across countries, Research Fellow Gian Luca Vriz and Professor Luca Taschini, together with Carolyn Fisher (World Bank) and Theodor Cojoianu (Singapore Management University), examine early signals of the EU CBAM’s impact on India’s iron and steel exporters. By combining firm-level export data with third-party estimates of emissions and production, their study delivers one of the first “ex post” looks at CBAM in action. The results show supply chain adjustments already aligned with EU policy: creating advantages for low-emission producers while reducing reliance on high-emission suppliers.

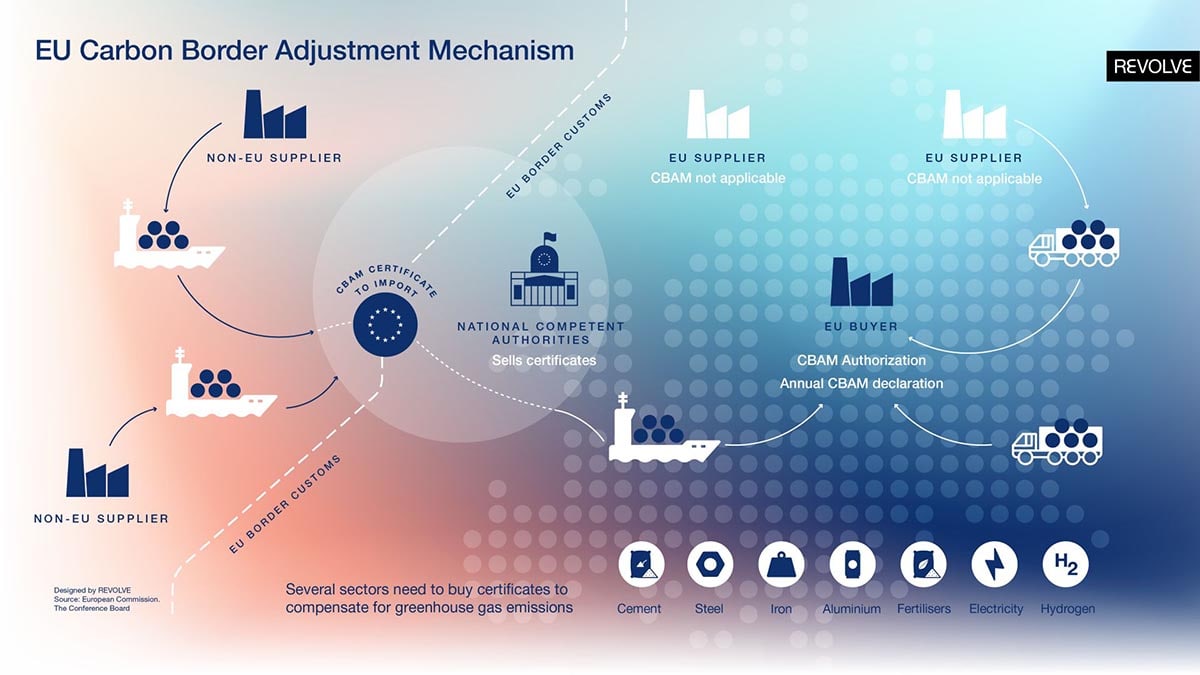

Image from Revolve magazine.

Debating the impact of CBAM on emission-intensive exporters

Climate policies vary globally, creating risks of carbon leakage for energy-intensive industries. In this view, Carbon Border Adjustment Mechanisms (CBAMs) aim to level carbon costs and incentivise cleaner production. However, the introduction of the EU CBAM has generated significant debate regarding its potential impact on emission-intensive exporters, with a common assumption that all firms in affected countries will face higher costs and lose competitiveness.

Overview of the EU CBAM

The EU introduced CBAM in October 2023 for sectors including cement, steel, iron, aluminium, fertilisers, electricity, and hydrogen, to cover half of EU ETS emissions. During the transitional phase, importers must report embedded emissions using EU equivalent methodologies or default values. By 2026, importers will be required to purchase CBAM certificates that match the EU ETS carbon costs.

The Indian iron and steel sector

India provides an ideal context for examining CBAM’s early signals for several reasons: its iron and steel production is highly emissions-intensive, and it plays a significant role in exporting these goods, especially to the EU.

Assessing differential trade responses to the CBAM

The study integrates firm-level export data from India with reliable estimates of emissions and production. CBAM reporting obligations create a different exposure across firms. Therefore, the analysis distinguishes between high- and low-emission firms to assess differential trade responses to the CBAM in its early stage.

CBAM can reshape competitive dynamics to favour cleaner producers

High-emission firms reduced shipment sizes and prices to the EU, while low-emission firms maintained or slightly increased trade, consistent with CBAM’s goals of favouring cleaner exporters. Unit price declines for high-emission firms reflect cost absorption or lower demand, whereas low-emission firms gained pricing power. These early signals illustrate how climate policies like CBAM can reshape competitive dynamics to favour cleaner producers.

Policy implications

The starting phase of the CBAM has still generated both trade and pricing adjustments in the EU-India steel sector. These (early sign) results suggest CBAM is already working as intended: rewarding cleaner producers while discouraging dirtier ones. Although specific to India, the findings highlight that CBAM creates not only challenges but also important opportunities: cleaner producers sustain or even improve their market positions, while more carbon-intensive firms face increasing pressure to adapt.

Key points for decision-makers

- CBAM is already shifting trade behaviour – high-emission firms are cutting shipment sizes and lowering prices, while low-emission firms are maintaining or improving their position.

- Impacts are differentiated, not uniform – the mechanism does not act as a blanket trade barrier; it distinguishes between cleaner and more carbon-intensive producers.

- New market opportunities – CBAM creates incentives for industrial decarbonisation and competitiveness gains for cleaner firms, but highlights the need to support access to low-carbon technologies and finance in emerging economies.

Read the full paper

Early signs the EU Carbon Border Adjustment Mechanism is reshaping EU-India steel trade

Gian Luca Vriz

Research Fellow in Climate Finance, Nature Statistics and Data Science, at the University of Edinburgh Business School

Theodor Cojoianu

Associate Professor of Sustainable Finance at Singapore Management University

Carolyn Fischer

Lead Economist and Research Manager at the World Bank Group

Luca Taschini

Chair in Climate Change Finance at the University of Edinburgh Business School